How to Check Salary in UAE? 10 Ways

Here are the top 5 ways to check your salary in the UAE. Based on a social survey we conducted, around 8.9 million workers are employed in the UAE. Many people from countries like Bangladesh, India, and Pakistan work in the UAE, often living far from their loved ones. If a worker doesn’t receive their wages, they can file a non-payment complaint with their employer on the UAE’s official website, MoHRE.

If you’re a laborer looking to check your salary, today’s article is for you. We’ll cover 5 easy ways to check your salary in Dubai. No matter where you are in the UAE—Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, or Fujairah—this article will guide you on how to check your salary.

How to Check Salary in UAE? 10 Ways

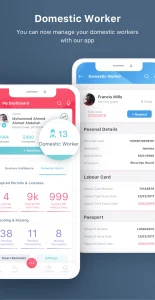

1. MoHRE App

The Ministry of Human Resources and Emiratisation (MoHRE) App is an essential tool for workers in the UAE. This app provides a convenient way to manage various employment-related tasks right from your smartphone.

Through the MoHRE App, you can easily check your salary, track your labor contract, and stay updated on any changes to labor laws and regulations. The app is designed to ensure transparency and to help protect workers’ rights.

By simply logging into the app, you can access your salary details, file complaints, and even seek assistance for any employment-related issues. It’s a one-stop solution for all your labor needs in the UAE.

Steps to Check Your Salary:

- Download the MoHRE App: Available on both Google Play Store and Apple App Store.

- Register/Login: Use your Emirates ID or mobile number to create an account or log in if you already have one.

- Navigate to Salary Information: Once logged in, go to the ‘Services’ section.

- Select ‘Wages Protection System (WPS)’: This will show your salary details and payment history.

- Check Salary Details: Review your latest salary information, payment dates, and any deductions or allowances.

2. Al Ansari Bank

Al Ansari Bank offers various services tailored for expatriate workers in the UAE, including easy access to salary information. With multiple branches across the UAE, Al Ansari Bank ensures that your banking needs are met conveniently.

They provide a secure and user-friendly online banking platform where you can check your salary deposits, manage your account, and transfer money to your home country.

The bank is known for its customer-friendly services and wide network, making it a reliable option for salary management. Whether you’re in Dubai, Abu Dhabi, or any other emirate, Al Ansari Bank has got you covered.

Steps to Check Your Salary:

- Visit Al Ansari Bank Website: Go to the official Al Ansari Exchange website.

- Login to Online Banking: Enter your credentials to access your account.

- Navigate to ‘Account Information’: Find this option in the main menu.

- Select ‘Salary Account’: This will display your salary details and transaction history.

- Review Salary Deposits: Check the latest salary deposits and balance.

3. LuLu Salary Card

The LuLu Salary Card is a popular choice among workers in the UAE for its simplicity and convenience. Issued by LuLu Exchange, this card allows you to access your salary without the need for a traditional bank account.

With the LuLu Salary Card, you can withdraw cash from ATMs, make purchases at retail outlets, and even transfer money internationally. The card is widely accepted and provides an easy way to manage your finances.

Additionally, you can check your salary balance and transaction history online, ensuring you always know the status of your funds.

Steps to Check Your Salary:

- Visit LuLu Exchange Website: Go to the official LuLu Exchange website.

- Login to Your Account: Use your card number and PIN to access your account.

- Navigate to ‘Card Services’: This option is available in the main menu.

- Select ‘Balance Inquiry’: Here, you can see your current balance and recent transactions.

- Check Salary Balance: Review your salary deposits and other transactions.

4. FAB Ratibi Salary Card

The FAB Ratibi Salary Card, offered by First Abu Dhabi Bank (FAB), is designed specifically for low-income workers in the UAE. This prepaid card allows you to receive your salary directly onto the card, which can then be used for various transactions such as ATM withdrawals, shopping, and online purchases.

The Ratibi card is a practical solution for those without a bank account, providing a secure and accessible way to manage your salary.

You can check your balance and monitor your spending through FAB’s online banking services, ensuring you stay on top of your finances effortlessly.

Steps to Check Your Salary:

- Visit FAB Website: Go to the official First Abu Dhabi Bank website.

- Login to Online Banking: Enter your card number and PIN to access your account.

- Navigate to ‘Prepaid Cards’: This section will display your Ratibi card details.

- Select ‘Balance Inquiry’: Check your current balance and recent transactions.

- Review Salary Deposits: Ensure your salary has been deposited and check your balance.

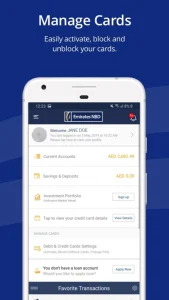

5. NBAD Bank

National Bank of Abu Dhabi (NBAD), now part of First Abu Dhabi Bank (FAB), offers a range of banking services suitable for expatriate workers.

With NBAD, you can open a salary account that allows you to receive and manage your wages efficiently. The bank provides robust online and mobile banking platforms where you can check your salary deposits, pay bills, and transfer funds.

NBAD is known for its extensive branch network and customer service, making it a reliable partner for managing your salary and other financial needs in the UAE.

Steps to Check Your Salary:

- Visit FAB Website: Go to the official First Abu Dhabi Bank website (since NBAD is now part of FAB).

- Login to Online Banking: Use your credentials to access your account.

- Navigate to ‘Accounts’: This section will display your various account details.

- Select ‘Salary Account’: Here, you can see your salary deposits and transaction history.

- Check Salary Details: Review your latest salary deposits and ensure everything is in order.